If you’re researching the Keiser University cost for 2025, this guide is designed to give you a clear, thorough breakdown of what it takes to attend, what you’ll pay, and how financial aid may reduce your out-of-pocket expenses. We’ll cover tuition, fees, living costs, and aid options—all focused on the U.S. context, using the most current data available.

Overview of Keiser University Cost

When evaluating the Keiser University cost, it’s important to look beyond just the sticker price of tuition. Total cost of attendance (COA) includes tuition, mandatory fees, books and supplies, room and board (if applicable), transportation, and other personal expenses. The official site indicates that the COA “reflects estimated expenses prior to financial aid awarding.

According to data for the undergraduate level at the flagship campus, average net cost (after grants and scholarships) was around $33,865 per year. But the full sticker cost for tuition, fees and living will be somewhat higher—so let’s dig into the specifics.

Tuition & Fees Breakdown

Undergraduate Tuition & Fees

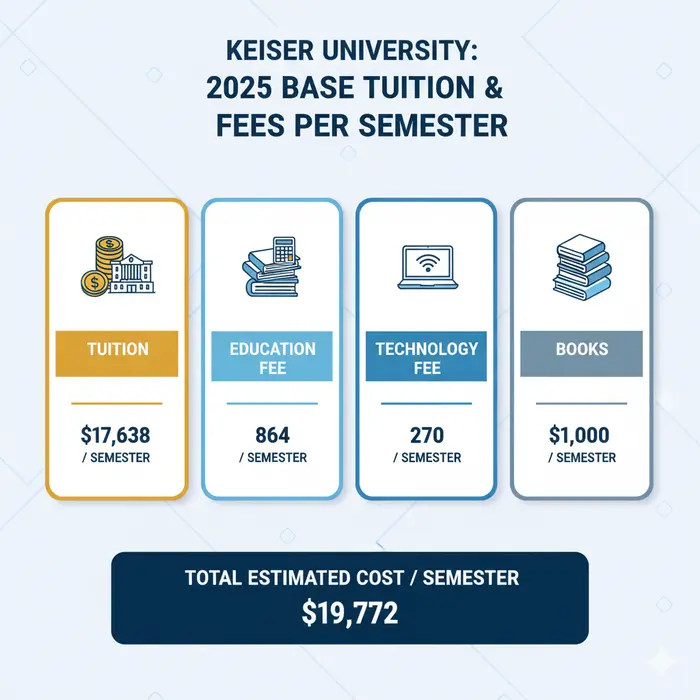

For the undergraduate programs at the flagship residential campus of Keiser University, the tuition breakdown for 12 to 17.99 credits (i.e., full-time) is approximately $17,638 per semester for tuition alone.Additional fees for the same semester include an education fee of about $864, and a technology fee of about $270.

If you add estimated books and supplies (~$1,000), then one semester (without housing) comes to roughly $19,772. Assuming two semesters, that gives a rough sticker price of $39,544 for tuition/fees/books only (no housing).

Graduate & Doctoral Tuition & Fees

At the graduate level, the tuition charge for 6 to 8.99 credits is approximately $9,324 per semester for the masters program (as of the 2023–2024 academic year). Add the education fee ($864) and technology fee ($270), plus estimated books ($1,000) and you get a semester cost (without housing) of about $11,458. For a full academic year (two semesters) that’s about $22,916.

Other Tuition Data

Other campuses (for example the Lakeland campus) report that for 2024-2025 the undergraduate tuition & fees are about $25,056 per year. Meanwhile, one source for the Fort Lauderdale campus cites “tuition & fees per year: $26,506” for 2025. The variance across campuses and programs means you’ll want to check the specific campus you’re considering.

Living Costs, Books & Miscellaneous Fees

When calculating the full Keiser University cost, you’ll want to account for housing, meals, books, and personal expenses.

- For example, at the residential flagship campus, estimated books for a semester are ~$1,000.

- Housing (on-campus, double occupancy) was listed in one semester as about $3,610 at Stauffer Hall and ~$4,258 at Lakeside residence hall.

- Meal plans: One estimate for a residential meal plan (19 meals per week + $150 flex) is approximately $3,567 per semester.

When you factor in these items, the total cost can easily reach $40,000+ per year for full time, residential attendance—before financial aid.

In one dataset the “average total cost” (tuition/fees + room & board + books & supplies) for the Fort Lauderdale campus is about $44,156 per year.

What to Expect for 2025: Estimating Costs

Since tuition tends to increase each year, here’s a look at what you might expect when considering the Keiser University cost for 2025.

- At the Lakeland campus, tuition & fees for 2025 are estimated at $25,056 (an increase of ~3.81% from the previous year).

- Other campuses may show similar or slightly higher increases.

Assuming you will pay:

- Tuition & fees: ~$25,000 to $40,000 depending on campus, program, and full-time/residential status

- Books & supplies: ~$2,000

- Housing/Meals/Personal: ~$12,000-20,000 (can vary widely)

- Total estimated cost of attendance could range in the ballpark of $35,000 to $50,000+ per year for full-time residential students.

Remember: non-residential or online students will typically have lower living cost components, reducing the total Keiser University cost.

Financial Aid and Net Costs

Understanding the gross sticker price is only half the story; the net cost (after aid) is what matters most for most students.

Aid & Scholarships

- At the Fort Lauderdale campus, 84% of students receive financial aid.

- The average aid package for students at that campus is about $7,627 per year.

- The average net price (after grants/scholarships) for undergraduates is around $33,865 per year.

Loans and Debt

- One source reports that 61% of undergrads borrow loans, with an average loan amount per year of approximately $13,590.

- Some sources indicate typical debt at graduation could reach around $45,050.

What this means for Net Cost

If we take the sticker price (say $44,000) and subtract average aid (~$7,600) you land near ~$36,000 per year for many students at the Fort Lauderdale campus. That aligns with the reported net price of ~$33,865. Thus, when planning for the Keiser University cost, you should anticipate both the published full cost and realistic net costs after aid.

Factors That Influence the Keiser University Cost

When you’re considering your own Keiser University cost, note that several variables will affect how much you’ll actually pay:

- Campus location & program: Tuition varies by campus (Lakeland, Fort Lauderdale, etc.) and by program (undergraduate vs graduate).

- Full-time vs part-time enrollment: Credit load affects cost. For example, at the residential flagship campus, 12-17.99 credits cost ~$17,638 per semester.

- Housing and meal choice: Living on-campus increases costs; commuting or online reduces them.

- Books, supplies, transportation: These “other costs” can add up.

- Financial aid eligibility: Grants/scholarships differ by student and family scenario.

- Annual tuition increases: Tuition tends to rise each year (3-4% was noted for Lakeland campus) so future years may cost more.

Paying for Keiser University Cost: Tips & Considerations

Here are some practical tips to help manage and plan for the Keiser University cost.

- Use the Net Price Calculator

The Keiser website offers a Net Price Calculator to estimate your personalized cost of attendance and potential aid. - Apply for Federal Student Aid

Submit the Free Application for Federal Student Aid (FAFSA) early to determine eligibility for federal grants, loans, and work-study. The school references this in its financial services guidance. - Explore Institutional Scholarships

Keiser offers scholarships and grants—make sure you inquire early about deadlines and eligibility. - Consider Housing Options Carefully

If the total cost is high, consider living off-campus or commuting, or choosing shared occupancy to reduce your total cost. - Budget for Books and Supplies

Even though textbooks may seem minor compared to tuition, budget ~$1,000-2,000 annually as indicated in disclosure forms. - Plan for Tuition Increases

If you’ll be enrolled multiple years, bear in mind tuition may increase each year. The Lakeland campus saw ~3.81% growth.

Is the Keiser University Cost Worth It?

Every student must assess whether the investment in tuition and related costs at Keiser will lead to a positive return. Consider:

- Program strength & career outcomes: What is the graduation rate, job placement, or salary outcomes for your program?

- Borrowing vs earning potential: If taking on loans, ensure the expected salary post-graduation makes the debt manageable.

- Comparison with alternatives: How does the cost compare with community colleges, public universities, or online options?

- Your personal goals and timeline: If you need flexibility, an online program or part-time enrollment may reduce your cost and risk.

The fact that the average net cost is around ~$33,865 (for undergraduates receiving aid) suggests many students are paying less than the full sticker price. But net cost is still significant—so the value proposition must align with your career plan.

Summary and Key Takeaways

- The Keiser University cost varies significantly by campus, program, full-time vs part-time, and housing choice.

- For the flagship campus, tuition for full-time undergraduates (12-17.99 credits) is around $17,638 per semester, with fees and books adding to roughly $19,772 per semester (before housing).

- Estimated full-time annual sticker cost (including housing, meals, books) can range $35,000 to $50,000+ depending on variables.

- Average net price (after aid) for undergraduates is approximately $33,865 per year.

- Financial aid is widely used (80-84%+ of students receive some aid) and can reduce out-of-pocket cost.

- To manage costs, use the Net Price Calculator, explore scholarships, budget housing and books, and factor in future tuition increases.

Final Thoughts

Understanding the Keiser University cost is crucial when planning for your education. The published tuition and fees give a starting point, but actual cost of attendance—and your personal net cost after aid—are what matter most. With careful planning, thoughtful housing and enrollment choices, and smart use of financial aid, you can make a more informed decision about whether Keiser University fits your budget and goals.

Verified Portals for Public Interest

- 1stHEADLINE.COM — Stay updated with top news, entertainment, and current affairs. Trusted journalism meets verified updates.

- MYTAMPANOW.COM — Local Tampa news and community stories. Your city, your headlines.

- EDPTRAININGS.IN — EDP and PMEGP training resources designed for entrepreneurs across India.

- 99FABRICS.IN — Premium supplier of lining, canvas, and jute materials trusted by garment professionals.

- WBINDIA.IN — Easy access to simplified updates on Central and State Government welfare schemes.

- KHADYASATHI.IN — Official West Bengal food and ration services portal for citizens.

- RATIONCARDINDIA.COM — Nationwide guide to ration card details, status updates, and EPDS services.

- EPDS2.RATIONCARDINDIA.COM — Reliable access point for public distribution and ration services.

- BANGLASTUDENTCREDITCARD.IN — State-backed education loan details for students in West Bengal.

- PURIHOTELBOOKING.CO.IN — Discover and book verified hotels and accommodations in Puri, Odisha.

- BANGLASHASYABIMA.NET.IN — Accurate details on crop insurance and benefits for West Bengal farmers.

- FIRSTHOMEOWNERGRANTS.COM — Helping first-time buyers in Australia with home grants and property insights.

- REGOCHECKER.COM — Quick car registration and history checks for Australian vehicle owners.

- USAFEDERALGRANTS.COM — Federal grant programs and financial aid opportunities in the United States.

- CARDYATRA.COM — India’s go-to platform for comparing credit cards, offers, and financial products.

- PMEGPEPORTAL.COM — A transparent source for checking your PMEGP loan status and progress.

- BESTUSCARACCIDENTLAWYERS.COM — Find trusted legal professionals specializing in car accident claims across the US.